NextEra Energy

’s

NEE

systematic capital expenditure to strengthen operations, strategic acquisitions and expanding renewable generation make it a solid investment option in the utility space.

Let’s focus on the factors that make this Zacks Rank #2 (Buy) stock a strong investment pick at the moment. You can see

the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here

.

Growth Projections

The Zacks Consensus Estimate for 2021 earnings per share has moved up 0.4% in the past 60 days to $2.53. The same for the top line for 2021 is $18.69 billion, indicating a year-over-year increase of 3.9%.

Surprise History and Earnings Growth

NextEra delivered an average earnings surprise of 6.1% in the last four reported quarters.

The company’s long-term (three to five years) earnings growth is projected at 8.4%.

Regular Investments & Emission Reduction

NextEra Energy has well-chalked out plans to invest nearly $34.5 billion in different projects during the 2022-2025 time period. These investments will be directed to modernize and strengthen the existing infrastructure, enabling it to serve the expanding customer base more effectively. These investments are also helping the company to produce more electricity from clean sources and lower carbon emissions from the production process.

It continues to add renewable assets to the generation portfolio and plans to reduce carbon emissions by 67% within 2025 from 2005 levels.

Systematic Acquisitions

NextEra Energy makes strategic acquisitions to expand operations. The acquisition of Gulf Power Company, Florida City Gas, and ownership stakes in two natural gas power plants from

The Southern Company

SO

will further expand regulated natural gas operations of NextEra Energy and be accretive to earnings over the long term. Acquisitions of GridLiance Holdco, LP and GridLiance GP, LLC (GridLiance) for nearly $660 million will allow the company to have control over 700 miles of high-voltage transmission lines, and related equipment across six states.

Given excellent growth opportunities in the water utility space, NextEra Energy Resources entered into an agreement to acquire a portfolio of rate-regulated water and wastewater utility assets in eight counties near Houston, TX. The proposed acquisition will expand the company’s regulated utility business in an attractive market with significant customer growth and further explore new opportunities in the water utility space.

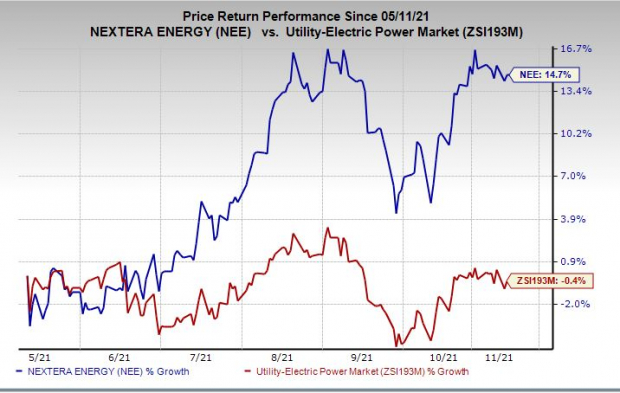

Price Performance

Over the past six months, the stock has returned 14.7% against the industry’s 0.4% decline.

Image Source: Zacks Investment Research

Other Stocks to Consider

Other top-ranked stocks in the same industry include

Dominion Energy

D

and

Alliant Energy Corporation

LNT

, each holding a Zacks Rank #2.

Dominion and Alliant Energy delivered an average earnings surprise of 2.4% and 4.4%, respectively, in the last four quarters.

The Zacks Consensus Estimate for 2021 earnings per share of Dominion and Alliant Energy has moved up 0.5%, and 0.8%, respectively, in the past 60 days.

More Stock News: This Is Bigger than the iPhone!

It could become the mother of all technological revolutions. Apple sold a mere 1 billion iPhones in 10 years but a new breakthrough is expected to generate more than 77 billion devices by 2025, creating a $1.3 trillion market.

Zacks has just released a Special Report that spotlights this fast-emerging phenomenon and 4 tickers for taking advantage of it. If you don’t buy now, you may kick yourself in 2022.

Click here for the 4 trades >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report