Southern Copper Corporation

SCCO

is expected to deliver year-over-year improvement in both revenues and earnings when it reports third-quarter 2021 results next week.

Q2 Results

In the last reported quarter, the company’s earnings and sales not only beat the Zacks Consensus Estimate but also improved year over year owing to higher metal prices.

The company has beat earnings estimates in each of the trailing four quarters, the average surprise being 10.2%.

Q3 Estimates

The Zacks Consensus Estimate for third-quarter 2021 earnings per share is currently pegged at $1.13, indicating an improvement of 74% from the prior-year quarter. The estimate has gone up 4% over the past 30 days. The consensus mark for the quarter’s revenues stands at $2.7 billion, suggesting year-over-year growth of 27%.

What the Zacks Model Unveils

Our proven Zacks model predicts an earnings beat for Southern Copper this time around. This is because the combination of a positive

Earnings ESP

and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the chances of an earnings beat, which is exactly the case here. You can see

the complete list of today’s Zacks #1 Rank stocks here

.

Earnings ESP

: The Earnings ESP for Southern Copper is +2.07%.

Zacks Rank

: Southern Copper currently carries a Zacks Rank of 3.

Key Factors to Note

Copper accounts for more than 80% of the company’s sales. Over the past few quarters, the company has been witnessing lower production at its Peruvian mines due to lower ore grades and this is expected to continue through 2022. Consequently, the third-quarter production numbers are likely to reflect this impact. This may, however, be somewhat offset by higher production at its Mexican mines and its Mexican underground operations (IMMSA unit) owing to increased production at the San Martin mine.

Overall silver production is likely to be lower on account of lesser production at Buenavista and IMMSA. Production of molybdenum, its main by-product, has been high due to rising production at the Peruvian mines, namely the Toquepala mine after throughput increased at the new Molybdenum plant, spurred by improvements in ore grades and recoveries at other operations. However, this might have been offset by lower production at Buenavista due to lower grades.

Copper prices have declined in the third quarter amid a stronger dollar and growing concerns about the health of the Chinese real estate market. Nevertheless, average copper prices remained higher than the year ago quarter. Average silver prices have been on a downtrend in the quarter due to reduced industrial demand and expectations of higher interest rates. Average silver prices have been down on a year-over-year basis. This is likely to get reflected in the company’s third-quarter top line. Operating cash costs are expected to have been higher in the to-be-reported quarter due to lower grades. This might have weighed on margins.

Share Price Performance

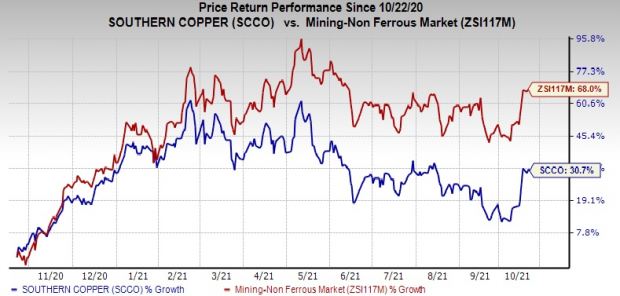

Image Source: Zacks Investment Research

The company’s shares have gained 30.7% over the past year compared with the

industry

’s rally of 68.0%.

Other Stocks to Consider

Here are some other Basic Materials stocks, which you may consider as our model shows that these too have the right combination of elements to post an earnings beat in their upcoming releases.

Teck Resources Ltd

TECK

has an Earnings ESP of +9.86% and a Zacks Rank of 1, currently.

Westlake Chemical Corporation

WLK

, a Zacks #1 Ranked stock, has an Earnings ESP of +1.22%.

WestRock Company

WRK

has a Zacks Rank #2 and an Earnings ESP of +0.25%, at present.

Infrastructure Stock Boom to Sweep America

A massive push to rebuild the crumbling U.S. infrastructure will soon be underway. It’s bipartisan, urgent, and inevitable. Trillions will be spent. Fortunes will be made.

The only question is “Will you get into the right stocks early when their growth potential is greatest?”

Zacks has released a Special Report to help you do just that, and today it’s free. Discover 7 special companies that look to gain the most from construction and repair to roads, bridges, and buildings, plus cargo hauling and energy transformation on an almost unimaginable scale.

Download FREE: How to Profit from Trillions on Spending for Infrastructure >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report