Harmony Gold Mining Company Limited

HMY

posted adjusted earnings of 60 cents per share for fiscal 2021 (ended Jun 30, 2021) against a loss of 10 cents recorded in the year-ago period.

Revenues and Costs

In fiscal 2021, revenues increased 45.2% to $2,710 million from $1,867 million registered a year ago. Average gold prices received during the period rose roughly 18% year over year to $1,719 per ounce (oz).

Gold production was around 1.54 million oz for the fiscal, up around 26% year over year.

Cash operating costs per oz declined 10% to $1,213. All-in-sustaining costs (AISC) declined 13% year over year to $1,460 per oz.

Financial Overview

As of Jun 30, 2021, cash and cash equivalents declined from $367 in the year-ago period to $198 million. Cash flow from operating activities surged 99% year over year to $597 million in fiscal 2021.

Net debt was $38 million at the end of fiscal 2021, down around 52% year over year.

Outlook

Harmony Gold plans to produce 1.55-1.63 million oz of gold in fiscal 2022. The company also expects an all-in sustaining cost between R765,000/kg-R800,000/kg. Underground recovered grade is forecast in the range of 5.40-5.57g/t.

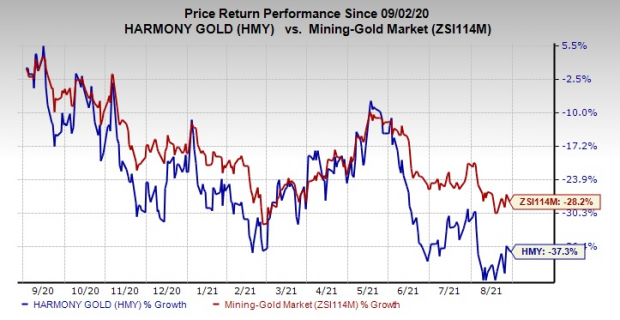

Price Performance

Shares of Harmony have declined 37.3% in the past year compared with 28.2% fall of the

industry

.

Image Source: Zacks Investment Research

Zacks Rank & Key Picks

Harmony currently carries a Zacks Rank #3 (Hold).

Some better-ranked stocks in the basic materials space are

Nucor Corporation

NUE

,

Dow Inc.

DOW

and

Cabot Corporation

CBT

.

Nucor has a projected earnings growth rate of around 494% for the current year. The company’s shares have soared 147.7% in a year. It currently sports a Zacks Rank #1 (Strong Buy). You can see

the complete list of today’s Zacks #1 Rank stocks here.

Dow has an expected earnings growth rate of around 403.01% for the current year. The company’s shares have gained 27.8% in the past year. It currently holds a Zacks Rank #2 (Buy).

Cabot has an expected earnings growth rate of around 138.5% for the current fiscal. The company’s shares have rallied 39% in the past year. It currently carries a Zacks Rank #2.

Infrastructure Stock Boom to Sweep America

A massive push to rebuild the crumbling U.S. infrastructure will soon be underway. It’s bipartisan, urgent, and inevitable. Trillions will be spent. Fortunes will be made.

The only question is “Will you get into the right stocks early when their growth potential is greatest?”

Zacks has released a Special Report to help you do just that, and today it’s free. Discover 7 special companies that look to gain the most from construction and repair to roads, bridges, and buildings, plus cargo hauling and energy transformation on an almost unimaginable scale.

Download FREE: How to Profit from Trillions on Spending for Infrastructure >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report