BHP Group

BHP

released production details for the year ended Jun 30, 2021 and provided guidance for fiscal 2022. Total iron ore production rose 2% to 254 Mt (million tons) in fiscal 2021 courtesy of record production at Western Australia Iron Ore (WAIO). The company met production guidance for iron ore, copper, metallurgical coal, nickel and energy coal. Petroleum production for the 2021 financial year was slightly above guidance.

Production Highlights

In the April-June quarter, BHP’s iron ore production was down 2% year over year to 65.2 Mt. On a sequential basis, production, however, improved 9% primarily due to enhanced performance at WAIO. Brazilian miner,

Vale S.A.

VALE

, reported its iron ore production for the second quarter of 2021 at 75.7 Mt, which came in 12% higher than the year-ago quarter and 11.3% higher than the first quarter of 2021. Last week,

Rio Tinto plc

RIO

reported a 9% drop in second-quarter iron ore production to 75.9 Mt due to above average rainfall in the West Pilbara.

For the year ended Jun 30, 2021, BHP’s total iron ore production improved 2% year over year to a record 253.5 Mt, within the company’s provided guidance of 245 Mt to 255 Mt. WAIO production was up 1% to a record 252 Mt reflecting record production at Jimblebar and Mining Area C, which included first ore from South Flank in May 2021. This performance was impressive considering weather impact, temporary rail labor shortages due to COVID-19 related border restrictions and the planned Mining Area C and South Flank major tie-in activity. Strong operational performance across the supply chain reflected continued improvements in car dumper performance and reliability, and train cycle times.

Total petroleum production was 102.8 MMboe (million barrels of oil equivalent) for the period under review, down 6% year over year. Total copper production was down 5% year over year to 1,635.7 kt in fiscal 2020. Metallurgical coal production dipped 1% to 40.6 Mt, while energy coal production was 19.3 Mt, down 17% year over year. Nickel production was up 11% year over year to 89 kt.

Average realized prices for iron ore, copper and nickel in fiscal 2021 surged 69%, 52% and 17% respectively. Average realized prices for metallurgical coal declined 19%, while of thermal coal rose 2%. Average realized prices for oil (crude and condensate) and Natural gas were up 6% and 8%, respectively, while LNG prices slumped 22%.

Fiscal 2022 Production Guidance

In fiscal 2022, BHP expects to produce between 249 and 259 Mt of iron ore compared with 253.5 Mt produced in fiscal 2021 as WAIO continues to focus on incremental volume growth through productivity improvements. The company’s petroleum production guidance for fiscal 2022 is expected to be 99-106 MMboe. BHP anticipates copper production between 1,590 kt and 1,760 kt in fiscal 2022. Production guidance of Metallurgical coal for fiscal 2022 is at 39-44 Mt, while the same for energy coal is at 13-15 Mt. Nickel production for fiscal 2022 is now expected between 85 kt and 95 kt.

Development Projects on Track

During fiscal 2021, BHP successfully achieved first production at four major development projects, all of which were delivered either on or ahead of schedule and also within budget. The Atlantis Phase 3 petroleum project and the Spence Growth Option copper project achieved first production in the first half of the financial year. During the fiscal fourth quarter, the South Flank iron ore sustaining project in Western Australia, and the Ruby oil and gas project in Trinidad and Tobago achieved first production.

As of Jun 31, 2021, the company had two major projects under development in petroleum (Mad Dog Phase 2) and potash (Jansen mine shafts), with both of these on track. The Jansen Stage 1 project in Canada remains on track for a go or no-go decision in the next two months.

On 28 Jun, 2021, BHP announced that it had signed a Sale and Purchase Agreement with

Glencore PLC

GLNCY

to divest its 33.3 per cent interest in Cerrejón, a non-operated energy coal joint venture in Colombia, for $294 million cash consideration. The transaction is expected to be completed in the second half of fiscal 2022.

BHP’s efforts to make operations more efficient through smart technology adoption across the entire value chain will continue to aid in reducing costs, thereby boosting margins. Focus on lowering debt will fuel growth.

Price Performance

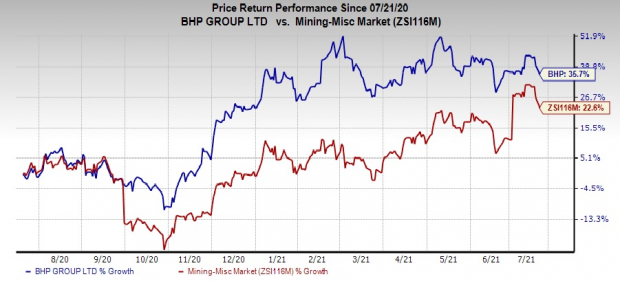

Image Source: Zacks Investment Research

Over the last year, BHP’s shares have gained 35.7%, compared with the

industry

’s rally of 22.6%.

Zacks Rank

BHP currently carries a Zacks Rank #2 (Buy). You can see

the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here

.

Zacks’ Top Picks to Cash in on Artificial Intelligence

In 2021, this world-changing technology is projected to generate $327.5 billion in revenue. Now Shark Tank star and billionaire investor Mark Cuban says AI will create “the world’s first trillionaires.” Zacks’ urgent special report reveals 3 AI picks investors need to know about today.

See 3 Artificial Intelligence Stocks With Extreme Upside Potential>>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report