AngloGold Ashanti Limited

’s

AU

wholly-owned subsidiary AngloGold Ashanti Holdings plc intends to acquire the remaining interest in Corvus Gold Inc. (“Corvus”) for a cash payment of $370 million. AngloGold currently owns 19.5% indirect interest in Corvus.

Based in British Columbia, Canada, Corvus owns several exploration assets, including North Bullfrog and Mother Lode located in Southern Nevada’s Beatty District, adjoining AngloGold’s exploration assets of Silicon, Transvaal and Rhyolite.

This buyout plan supports AngloGold’s focus on expanding ore reserve, building low-cost production and generating sustainable returns. Together, Corvus and AngloGold’s exploration assets will form one of the largest new gold districts in Nevada, while providing scope for AngloGold to create a meaningful, low-cost, long-life production base in a premier mining jurisdiction over the long term.

AngloGold’s buyout proposal comes after Corvus entered into a loan agreement of $20 million with AngloGold North America Inc. on May 6. Per the agreement, AngloGold was granted an initial exclusivity period of 90 days, during which the company was allowed to conduct a detailed due diligence procedure on Corvus and its key assets. The agreement also states that the initial exclusivity period would be further extended by 30 days as AngloGold submits proposal to acquire Corvus assets.

The company is focused on developing key projects across its portfolio. The Obuasi Redevelopment Project was 97% completed during the March-end quarter. AngloGold is on track to meet its priorities for the current year, which includes reinvestment to increase reserves, extend mine lives and improve mining flexibility.

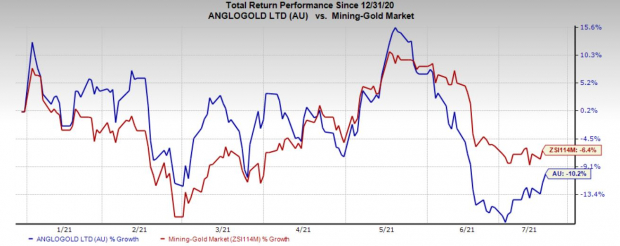

Price Performance

AngloGold’s shares have declined 10.2% so far this year, compared with the

industry

’s loss of 6.4%.

Image Source: Zacks Investment Research

Zacks Rank & Stocks to Consider

AngloGold currently carries a Zacks Rank #3 (Hold).

Better-ranked stocks in the basic materials space include

Commercial Metals Company

CMC

,

Nucor Corporation

NUE

and

Cabot Corporation

CBT

, each flaunting a Zacks Rank #1 (Strong Buy), at present. You can see

the complete list of today’s Zacks #1 Rank stocks here.

Commercial Metals has a projected earnings growth rate of 21.9% for fiscal 2021. The company’s shares have rallied around 51.9% in a year’s time.

Nucor has a projected earnings growth rate of 259.9% for the current year. The company’s shares have soared around 130% over the past year.

Cabot has an expected earnings growth rate of around 126% for the current fiscal year. The company’s shares have surged 60% in the past year.

Bitcoin, Like the Internet Itself, Could Change Everything

Blockchain and cryptocurrency has sparked one of the most exciting discussion topics of a generation. Some call it the “Internet of Money” and predict it could change the way money works forever. If true, it could do to banks what Netflix did to Blockbuster and Amazon did to Sears. Experts agree we’re still in the early stages of this technology, and as it grows, it will create several investing opportunities.

Zacks’ has just revealed 3 companies that can help investors capitalize on the explosive profit potential of Bitcoin and the other cryptocurrencies with significantly less volatility than buying them directly.

See 3 crypto-related stocks now >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report