NETGEAR Inc.

NTGR

recently augmented its portfolio by introducing a product in the Insight Managed Wi-Fi 6 Access Points lineup. Dubbed the Insight Managed WiFi 6 AX6000 Tri-band Multi-gig Access Point (“WAX630”), the product is likely to be a strategic fit for small and medium enterprises with open spaces for delivering Wi-Fi connectivity to a large number of concurrent users.

Interoperable with other Insight Managed Access Points, WAX630 reportedly offers about 40% higher speed to each connected device compared to WiFi 5 (802.11ac standard). Leveraging indigenous wireless backhaul technology, Instant Mesh, WAX630 provides wireless connection between two devices to expand Wi-Fi coverage without the use of cables. This makes it ideal for schools, colleges, mid-sized manufacturing facilities, warehouses and office premises.

Equipped with two Ethernet ports, namely a Gigabit Ethernet port and a Power-over-Ethernet (PoE++) 2.5 Gigabit Ethernet port, WAX630 is perfect for high-density deployments. Its tri-band architecture delivers industry-leading network performance with the capability to set up VLANs and up to 16 different SSIDs (Service Set Identifiers) in multiple wireless networks. This, in turn, is likely to strengthen NETGEAR’s leading position in the market.

The company continues to introduce new products and services that hinge on affordability, reliability and ease of use. In order to capitalize on the increasing demand for cloud-based applications for small and medium-sized enterprises, NETGEAR is introducing next generation commercial products. These include PoE switches, Multi-gigabit Ethernet switches, high capacity local and remote unified storage, small to medium capacity campus wireless LAN and security appliances. These products are likely to augment the effectiveness and efficiency of its hybrid cloud access network and strengthen its position in the market.

With improved supply chain scenario, NETGEAR is likely to bolster positive cash flow and boost its paid subscriber base to drive the momentum in 2021. Solid work-from-home networking market backed by a robust demand environment is a major tailwind as well.

In addition, with an exponential growth in data traffic, consumers, businesses and service providers need a complete set of wired and wireless networking and broadband products that are tailored to their specific needs and budgets. The company’s products are designed with an industrial appearance, including metal cases, the ability to mount the product within standard data networking racks as well as unique mounting solutions for other uses and targeting the business market. These products typically include higher port counts, higher data transfer rates and other performance characteristics designed to meet the needs of a business user, providing a competitive edge to outsmart its rivals.

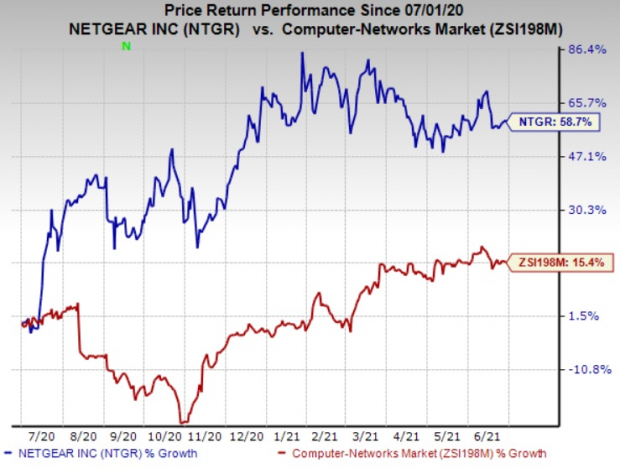

Shares of NETGEAR have gained 58.7% in the past year compared with the

industry

’s rise of 15.4%.

Image Source: Zacks Investment Research

We remain impressed with the inherent growth potential of this Zacks Rank #3 (Hold) stock. Some better-ranked stocks in the broader industry are

Aviat Networks, Inc.

AVNW

,

ATN International, Inc.

ATNI

and

Nokia Corporation

NOK

, each carrying a Zacks Rank #2 (Buy). You can see

the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here

.

Aviat delivered a trailing four-quarter earnings surprise of 57.3%, on average.

ATN International delivered an earnings surprise of 424.2%, on average, in the trailing four quarters.

Nokia delivered an earnings surprise of 215.2%, on average, in the trailing four quarters.

Bitcoin, Like the Internet Itself, Could Change Everything

Blockchain and cryptocurrency has sparked one of the most exciting discussion topics of a generation. Some call it the “Internet of Money” and predict it could change the way money works forever. If true, it could do to banks what Netflix did to Blockbuster and Amazon did to Sears. Experts agree we’re still in the early stages of this technology, and as it grows, it will create several investing opportunities.

Zacks’ has just revealed 3 companies that can help investors capitalize on the explosive profit potential of Bitcoin and the other cryptocurrencies with significantly less volatility than buying them directly.

See 3 crypto-related stocks now >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report