Nokia Corporation

NOK

recently conducted a successful trial with Vodafone Turkey, an operating unit of

Vodafone Group Plc

VOD

, to test the efficacy of intercontinental connectivity with the first 1T (terabit) clear-channel IP interface. The trial is part of the network modernization initiative of Vodafone Turkey, as it aims to scale up operations to effectively handle exponential growth in data traffic.

The test was undertaken by using Nokia’s 7950 XRS (Extensible Routing System) routers with terabit interfaces powered by its FP4 chipset. Leveraging modular and extensible hardware design that ensures granular and economical scaling up to 96 Tb/s HD capacity in a standard 19” rack, 7950 XRS routers enable carriers to build a versatile, reliable and converged core network. It helps to address the entire range of core routing requirements on common hardware with a flexible, pay-as-you-go software licensing model.

The FP4 network processor is the reportedly the world’s first 3.0 Tb/s network processor and enables service providers and webscale operators to implement vast IP networks without sacrificing on performance. The FP4 terabit linecard offers two 1T ports that boost network capacity by about 10 times, simplifying operational complexity and cost overhead by eliminating the requirement of multiple lower rate interfaces in link aggregation groups. The multi-access mobile transport architecture will deliver high capacity, low latency 5G services to optimize network functioning and facilitate Vodafone Turkey to ramp up operations to better serve one of the world’s largest intercontinental markets.

By unlocking network efficiencies with common operability, software delivery and increased hardware sharing, Nokia has been able to reduce the total cost of ownership for mobile operators. The company is well positioned for the ongoing technology cycle given the strength of its end-to-end portfolio. Its installed base of high-capacity AirScale product, which enables customers to quickly upgrade to 5G, is growing fast. The company is driving the transition of global enterprises into smart virtual networks by creating a single network for all services, converging mobile and fixed broadband, IP routing and optical networks with the software and services to manage them. Leveraging state-of-the-art technology, Nokia is transforming the way people and things communicate and connect with each other. These include seamless transition to 5G technology, ultra broadband access, IP and Software Defined Networking, cloud applications and Internet of Things.

The company facilitates its customers to move away from an economy-of-scale network operating model to demand-driven operations by offering easy programmability and flexible automation needed to support dynamic operations, reduce complexity and improve efficiency. Nokia remains focused on building a robust scalable software business and expanding it to structurally attractive enterprise adjacencies. It has inked more than 165 commercial 5G contracts across the globe. The company’s end-to-end portfolio includes products and services for every part of a network, which are helping operators to enable key 5G capabilities, such as network slicing, distributed cloud and industrial IoT. Accelerated strategy execution, sharpened customer focus and reduced long-term costs are expected to position the company as a global leader in the delivery of end-to-end 5G solutions.

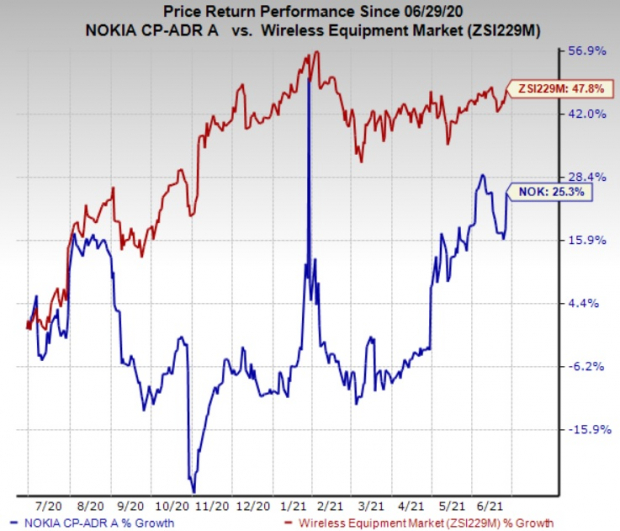

The stock has gained 25.3% in the past year compared with the

industry

’s rally of 47.8%.

Image Source: Zacks Investment Research

Nokia currently has a Zacks Rank #2 (Buy). Some other top-ranked stocks in the industry are

Aviat Networks, Inc.

AVNW

and

ATN International, Inc.

ATNI

, both carrying a Zacks Rank #2. You can see

the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here

.

Aviat delivered an earnings surprise of 57.3%, on average, in the trailing four quarters.

ATN International delivered an earnings surprise of 424.2%, on average, in the trailing four quarters.

Bitcoin, Like the Internet Itself, Could Change Everything

Blockchain and cryptocurrency has sparked one of the most exciting discussion topics of a generation. Some call it the “Internet of Money” and predict it could change the way money works forever. If true, it could do to banks what Netflix did to Blockbuster and Amazon did to Sears. Experts agree we’re still in the early stages of this technology, and as it grows, it will create several investing opportunities.

Zacks’ has just revealed 3 companies that can help investors capitalize on the explosive profit potential of Bitcoin and the other cryptocurrencies with significantly less volatility than buying them directly.

See 3 crypto-related stocks now >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report