If you’re wondering where in the world you can find an unimaginably vast territory rich not only in gold but in all the metals deemed strategic for the 21st-century economy, yet still largely untapped … we think you don’t have to look far.

Canada’s Quebec province, a massive

1.7 million km²

, contains one of the most diverse collections of metals in the world…

Only 1% of it is being mined.

And only 5% is covered by mining rights.

It’s a mecca of gold, silver, iron, nickel, titanium, niobium, copper, and zinc.

But most recently, thanks to junior explorer

Starr Peak Mining Ltd. (

TSX:STE.V

;

OTC:STRPF

),

the gold rush is on again.

Only this time, it’s not just gold. It’s the holy grail of mining that has eluded the major players for a century: A VMS (Volcanogenic Massive Sulphide) deposit with rock containing multiple base metals, including zinc, copper, silver, and gold.

Starr Peak

was

after gold, but what it encountered on its first drill hole was much more.

We think this has been one of the best mining narratives in a decade.

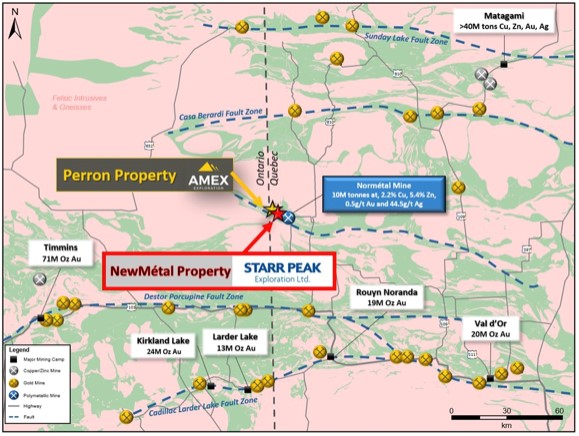

In this same location last year,

Amex Exploration

(TSX:AMEX) made a high-grade gold discovery right next to the past-producing Normetal Mine, which has historically produced ~10.1 million tonnes of 2.15% copper, 5.12% zinc, 0.549g/t of gold and 45.25 g/t of silver.

That got our attention.

What held it was this: Right before that discovery, Starr Peak moved to acquire a huge position adjacent to Amex, and then it bought the Normetal Mine itself.

Amex ended up with a huge discovery on its Perron Property, right next to Normetal. That find netted investors up to 7,000% returns. And while investors were quietly accepting their gains, the behind-the-scenes action with Starr Peak was building exciting momentum.

In February, Starr Peak started its fully funded 20,000-meter drill campaign.

By the first week of May, Starr Peak released its first

drill results

that went beyond our expectations.

What Starr Peak found was better than gold

Volcanogenic massive sulfides have been around as long as the earth itself.

But VMS discoveries have been few and far between.

VMS deposits were formed on the ocean floor during ancient underwater volcanic activity and then ended up on land that was once underwater due to tectonic plate movements.

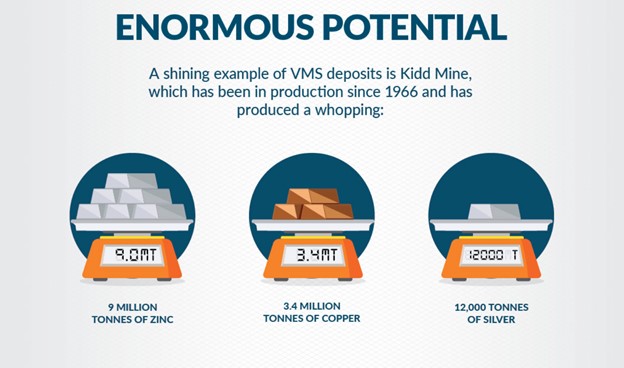

One of the rare VMS discoveries is the Kidd Mine in Ontario, Canada, in production since 1966, and owned and operated by Glencore Plc.

Big mining companies tend to hover around any potential for these deposits … even more so if the exploration is made by a junior explorer who does all the hard work proving it up.

That’s when we think junior mining stocks could see three-digit gains. Amex saw gains like these and it only found gold.

Starr Peak (

TSX:STE.V

;

OTC:STRPF

)

, whose shareholders now include Amex founders, is hoping to prove up much more than that, including silver, copper, and zinc.

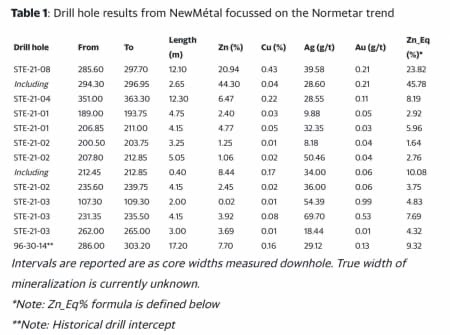

On its first drill at its NewMetal project, which includes the Normetal Mine, Starr Peak confirmed the presence of zinc-rich massive sulfide intervals returning zinc, copper, silver, and gold:

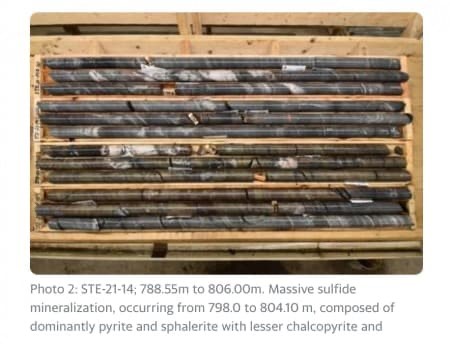

And massive sulfide mineralization …

Proving up this play would mean a brilliant diversification of strategic metals for Starr Peak. It could also put them on some big mining radar.

Johnathan More, Chairman, and CEO of Starr Peak, commented on May 4th “I am thrilled with the large intervals of high-grade sulfide mineralization from our first-ever drilling campaign at NewMétal. We targeted an area adjacent to a high-grade past-producing mine with the expectation that modern geophysical tools and three-dimensional modeling would unlock the value of the surrounding rocks. […] We are also very excited with the interception of massive sulfides at approximately 680 m depth in a BHEM anomaly that is showing much higher conductance than other targets which could indicate an increase in chalcopyrite concentration.”

Because of the significant VMS intercepts in the first drill, Starr Peak expanded its drill plans from 5,000 to 20,000 meters and brought on a

3rd drill rig

, with lab results reported to be expected any day now.

Aiming for the Second Major Discovery in a Year

What happened to Amex could happen again. Only this time it could possibly be even bigger.

That’s why we think Amex founders latched onto Starr Peak (

TSX:STE.V

;

OTC:STRPF

)

right away.

And right before Starr Peak announced its maiden drill results with evidence of a VMS discovery, the Chairman and founder of Amex was appointed as Starr Peak’s Chief Technical Advisor.

That’s

Dr. Jacques Trottier, PhD

, a seasoned geologist, with experience on VMS type deposits.

“I am very pleased to join the technical exploration team of Starr Peak. I am very familiar with their NewMétal polymetallic project which is located just next to Amex’s Perron Gold project. Having been involved and worked on VMS-type deposits throughout my career, this project appears to be very promising. Prior to joining the advisory board, I completed an initial review of the technical data available and I believe this project has the potential to host new additional mineralized areas similar to other significant deposits of the same type, namely the former Normetal Mine and the Normetmar showing located on this property,” Trottier said in a statement.

Trottier thinks Starr Peak could be a repeat of the Amex success, which rewarded investors with up to 7,000% gains.

Amex is now a big name in Quebec gold. And all the while, it looks to be drilling closer and closer to Starr Peak’s property, with more

promising drill results

for gold. Amex still has ~$30 million in cash to keep drilling.

For nearly a century, big miners have been looking for Quebec’s unexplored VMS deposits. We think an unknown junior miner might just find it, when they were only looking for gold. This is the type of narrative that potentially ends up minting millionaires and we think could put Starr Peak on the path to the major mining leagues.

Keep your eyes on this one because the next big move could come with more lab results from this very exciting ongoing drill program.

Here are some other miners to watch closely over the coming months:

AngloGold Ashanti (NYSE:AU),

though it has had some problems over the past decade, specifically in the early 2010s when the gold market took a major hit forcing many miners, including AngloGold to shutter operations,t has persevered. AngloGold has been recording highly impressive bottom-line expansion. The miner’s performance has been underpinned by a record year at Geita as well as remarkable performances at the Kibali, Sunrise Dam, Iduapriem, Siguiri, and AGA Mineração operations.

AngloGold, the third-largest gold company by production volume, is one of the more diverse miners on the planet, shielding itself from country-specific regulatory troubles or civil strife. It has operations on four continents including Africa, Australia, South America and North America.

While AngloGold hasn’t performed quite as well as some of its peers over the past year, it has shown that it still has the potential for long-term growth. Back in 2015, the company’s share price dropped to just $5.97, but since then, investors who have been able to hold onto the stock have seen a 401% return over a five-year span.

Kinross Gold Corp. (NYSE:KGC, TSX:K)

, one of the world’s largest gold producers, is constantly looking to expand its operations and has found success in many regions. The company mines for gold across six continents, with operations in Brazil, Ghana, Mauritania, Russia and the United States. It also operates a joint venture with AngloGold Ashanti Limited that provides mining services at two sites in West Africa—one of which was recently awarded an environmental permit from the government of Guinea.

Kinross Gold Corporation sets itself apart in the industry. It is a profitable company–consistently. It’s a safer bet, if not one that will deliver you stunning upside. This is for the more cautious gold investor. Just like AngloGold, Kinross has been enjoying dramatic improvements in profit margins and cash flow thanks to the surge in gold prices–and this trend appears set to continue with the gold outlook remaining decidedly bullish. With all factors remaining constant, Kinross should be able to realize high single-digit EPS expansion in the current year.

Kirkland Lake Gold (NYSE:KL, TSX:KL)

is another one of Canada’s most significant gold miners. Though not quite as established as Barrick or Newmont, Kirkland is no stranger to striking headline-grabbing deals in the industry. In fact, just recently, Kirkland and Newmont signed a $75 million exploration deal that could wind up being a game-changer for the industry. The two companies have agreed to split the cost 50/50 over five years with each company investing $15 million every year into joint projects between both companies for exploration purposes only – at this point it seems like a win.

This alliance will provide Kirkland with cash flow to evaluate new alternatives for the future of the mining complex, dive deeper into its existing properties, and weigh other opportunities where the two gold companies may be able to find common ground in the future.

According to a joint press release in late 2020, “Newmont has acquired an option from Kirkland on the mining and mineral rights subject to a royalty payable by Newmont to Royal Gold, Inc. (the Holt Royalty) in exchange for a $75 million payment to Kirkland Lake Gold. Newmont can exercise the Option only in the event Kirkland intends to restart operations at the Holt Mine and process material subject to the Holt Royalty”

In 2021, iconic investor Warren Buffett surprisingly did a 180 on his long-held negative stance on gold when Berkshire Hathaway announced that it would be taking a massive stake in Canadian

Barrick Gold (NYSE:GOLD, TSX:ABX

) at a time when gold was soaring. This change in attitude towards gold by Buffett could affect how many other investors view it as an investment opportunity. Buffett’s investment in Barrick and change in tune on the gold front shouldn’t come as much of a surprise, however. As the future of the economy looks more-and-more uncertain, and the Federal Reserve continues to print money at a record rate, solid gold miners like Barrick have drawn a lot of attention for investors, especially considering the healthy 0.96% dividend per share that comes with the purchase.

Barrick is a top-tier gold miner with a global footprint. The Toronto-based gold giant operates in 13 countries, including Argentina, Canada, Chile, Côte d’Ivoire, Democratic Republic of the Congo, Dominican Republic, Mali, Papua New Guinea, Saudi Arabia, Tanzania, the United States and Zambia. Though Newmont surpassed Barrick as the largest gold miner when it acquired Goldcorp, Barrick is still a force to be reckoned with.

Newmont

(

NYSE:NEM, TSX:NGT

) is the largest gold company on the planet, but that doesn’t mean it doesn’t still have upside potential. As far as management goes Newmont doesn’t have any weak spots. Its board includes veteran mining executives like Bob McAdam of Barrick Gold Corp., Tom Albanese of Rio Tinto plc (NYSE:RIO), Joe Jimenez of Dow Chemical Company (DOW) and John Wiebe of Kinross Gold Corporation (KGC). The company has a solid balance sheet with little debt and it’s still growing. Founded in 1916, and based in Greenwood Village, Colorado, Newmont is a veteran miner with one of the top executive teams in the business, and its operations span 11 countries, including gold mines in Nevada, Colorado, Ontario, Quebec, Mexico, the Dominican Republic, Australia, Ghana, Argentina, Peru, and Suriname.

The big news for the company in 2019 was its acquisition of Goldcorp. Though it was controversial at the time, the $10 billion acquisition has paid off in a big way. As gold climbed to record highs thanks to investors piling into gold due to the COVID pandemic, Newmont has seen a boom in its share price. This path has been very closely related to the price of gold which has also tumbled in the same amount of time. That said, the company still has a lot of upside potential, and with Biden preparing to unleash a new infrastructure bill that will add more debt to America’s $28 trillion bill, investors will likely look into gold again this year.

Yamana Gold (NYSE:AUY, TSX:YRI)

, one of the world’s top gold companies, has seen its share price hit especially hard this year. Yamana had been on an upward trend since February when it announced that three mines were closing and more than 1 billion dollars would be cut from their budgets as part of ongoing austerity measures due to slumping prices for precious metals and weak demand for mining equipment across the industry.

Earlier in 2021, Yamana signed an agreement with industry giants Glencore and Goldcorp to develop and operate another Argentinian project, the Agua Rica. Initial analysis suggests the potential for a mine life in excess of 25 years at average annual production of approximately 236,000 tonnes (520 million pounds) of copper-equivalent metal, including the contributions of gold, molybdenum, and silver, for the first 10 years of operation.

While

Freeport-McMoRan (NYSE:FCX)

is primarily known for its significant copper mining operations, the resource giant also has a fair influx of gold as well. In fact, its Grasberg mine in Indonesia holds of the world’s largest deposits of copper and gold. But that’s just scratching the surface of the miner’s global assets. Freeport-McMoRan also has extensive operations across the Americas, including mines in Arizona, Mexico and Peru.

Though its business struggled as global demand for copper took a hit, panic-buying from China has lifted prices higher in recent months – and that’s good news for Freeport-McMoRan. In addition to climbing copper prices, gold prices hit record levels, which will add even more to the mining giant’s bottom line.

Freeport-McMoRan has had an incredible year, with the price of its stock bouncing off a low of $8.74 back in May 2020 to today’s price of $37, representing a near-400% increase in just one year’s time.

By. Jilly Rogers

**IMPORTANT! BY READING OUR CONTENT YOU EXPLICITLY AGREE TO THE FOLLOWING. PLEASE READ

CAREFULLY**

Forward-Looking Statements /

This publication contains forward-looking information which is subject to a variety of risks and uncertainties and other factors that could cause actual events or results to differ from those projected in the forward-looking statements. Forward looking statements in this publication include that prices for gold, silver, copper, zinc and other base metals will retain their value in future as currently expected, or could continue to increase due to global demand and political reasons; that Starr Peak can fulfill all its obligations to acquire its Quebec properties; that Starr Peak’s property can continue to achieve drilling and mining success for gold and other metals; that historical geological information and estimations will prove to be accurate or at least very indicative; that high-grade targets exist; that Starr Peak will be able to carry out its business plans, including future exploration and drilling programs; that the preliminary drilling results will be confirmed as further exploration continues; that the lab results from Starr Peak’s initial exploration program will confirm evidence of a significant VMS deposit; that Starr Peak’s exploration results will gain the attention and interest of larger mining companies and investors; that Starr Peak’s exploration results will continue to show promising results justifying ongoing exploration and possible development efforts. These forward-looking statements are subject to a variety of risks and uncertainties and other factors that could cause actual events or results to differ materially from those projected in the forward-looking information. Risks that could change or prevent these statements from coming to fruition include that politics don’t have nearly the strong effect on gold and other base metal prices as expected; that demand for base metals may not continue to increase; that the Company may not complete all its announced mineral property purchases for various reasons; that the Company may not be able to finance its intended drilling and exploration programs; Starr Peak may not raise sufficient funds to carry out its business plans; that geological interpretations and technological results based on current data may change with more detailed information or testing; that the lab results from Starr Peak’s initial exploration program may not support evidence of a significant VMS deposit; that the preliminary drilling results may not be confirmed during further exploration efforts; that Starr Peak will fail to gain the attention and interest of other mining companies and investors; that Starr Peak’s exploration results may fail to find additional promising results justifying ongoing exploration and/or development efforts; and despite promising results from drilling and exploration, there may be no commercially viable minerals or ore on Starr Peak’s property. The forward-looking information contained herein is given as of the date hereof and we assume no responsibility to update or revise such information to reflect new events or circumstances, except as required by law.

DISCLAIMERS

This communication is for entertainment purposes only. Never invest purely based on our communication. We have not been compensated by Starr Peak but may in the future be compensated to conduct investor awareness advertising and marketing for TSXV:STE. The information in our communications and on our website has not been independently verified and is not guaranteed to be correct.

SHARE OWNERSHIP. The owner of Oilprice.com owns shares of Starr Peak and therefore has an additional incentive to see the featured company’s stock perform well. The owner of Oilprice.com will not notify the market when it decides to buy more or sell shares of this issuer in the market. The owner of Oilprice.com will be buying and selling shares of this issuer for its own profit. This is why we stress that you conduct extensive due diligence as well as seek the advice of your financial advisor or a registered broker-dealer before investing in any securities.

NOT AN INVESTMENT ADVISOR. The Company is not registered or licensed by any governing body in any jurisdiction to give investing advice or provide investment recommendation.

ALWAYS DO YOUR OWN RESEARCH and consult with a licensed investment professional before making an investment. This communication should not be used as a basis for making any investment.

RISK OF INVESTING. Investing is inherently risky. Don’t trade with money you can’t afford to lose. This is neither a solicitation nor an offer to Buy/Sell securities. No representation is being made that any stock acquisition will or is likely to achieve profits.