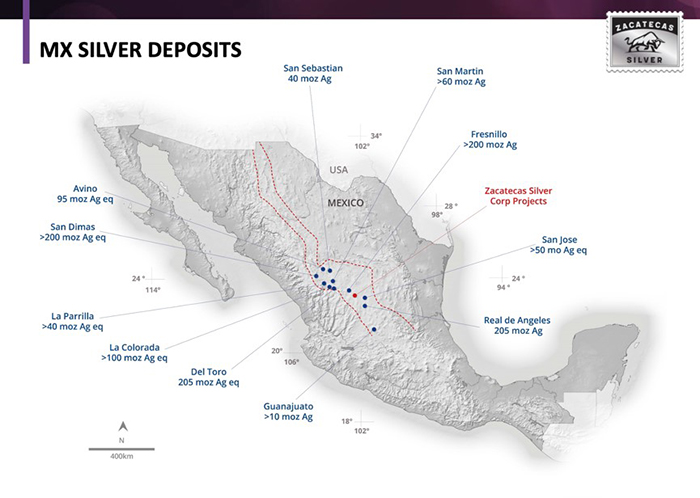

If a company is looking to increase its odds to produce gold, it should consider China, Russia and Australia, the top three producing countries in 2019. If the goal is silver, Mexico is the place to be with approximately 190 million ounces of the world’s 837 million ounces coming from the country in 2019. More precisely, the Fresnillo Silver Trend in central Mexico has been a veritable silver hotbed for centuries, producing more than 6.2 billion ounces of silver, or in excess of 10% of the world’s historic production.

The NW-SE trending Fresnillo Silver Trend is home to projects of major silver companies like First Majestic Silver (NYSE: AG)(TSX: FR), Pan American Silver (TSX: PAAS)(NASDAQ: PAAS), Endeavour Silver (NYSE: EXK)(TSX: EDR) and an upstart that just came public Tuesday, Zacatecas Silver Corp. (TSX-V: ZAC). As it happens, Zacatecas’ huge 19,338 acre property is located southeast of First Majestic and Pan American projects hosting over 345 million ounces of silver and 25 kilometers southeast of MAG Silver’s (NYSE American: MAG)(TSX: MAG) Juanicipio Mine that commenced production in Q4 2020 and the 200-million-ounce Fresnillo mine of Peñoles, the second largest mining company in Mexico. Bolañitos, which produced 1.9 million ounces silver equivalent (Ag Eq) in 2020 and was the lowest-cost mine in Endeavor’s portfolio, is to the southeast of Zacatecas’ properties.

Silver was discovered in the Zacatecas area in 1546, with production coming from three mines within two years after. The Albarrada Mine was pulling silver from the Veta Grande vein system, while the San Bernabe and Los Tajos Mines were working the Mala Noche vein systems. By the late 1800’s, Zacatecas district silver accounted for 60% of the value of all Mexican exports. Through 1987, it is estimated that about 747 million ounces of silver had come from the district all-time.

19.5 Million Ounces of Silver

Against the backdrop of the prolific reserves of others in the region, Zacatecas has some strong showings of its own, including a 2019 historic report by Santacruz Silver Mining Ltd. from the Panuco deposit located in the northern part of the concessions. The most advanced prospect of Zacatecas, the Panuco report has a historic inferred mineral resource of 19.47 million ounces Ag Eq (cut-off 100 g/t Ag Eq.) from 3.95 million tonnes at 153.2 g/t Ag Eq (136 g/t Ag, 0.14 g/t Au, 0.012% Pb, 0.11% Zn).

75 HQ diameter diamond holes totaling about 47,000 meters have been drilled at Panuco, as recently as 2011. Exploration has defined three prominent veins (Panuco NW, Panuco Central and Tres Cruces) and vein breccias that have been collectively traced over a 4-kilometer strike length along with additional vein splays and jogs noted. Intercepts from drilling at Panuco showed grades up to 668 grams per tonne (g/t) silver and 1.05 g/t gold across 1.50 meters.

Time to Validate and Add to the Silver Estimate

The company is not wasting any time re-modeling the historic resource, already completing an extensive verification re-sampling program of historical drill core (equating to ~15% of sample intervals used in the estimate) as it preps for a new drill program designed to expand the estimate in the future.

Mineralization at the Panuco veins remains open along strike and down dip, making them top priorities for upcoming drilling by Zacatecas to better understand the resource, particularly areas outside those comprising the historic resource estimate. Management plans to immediately complete a 10,000-meter confirmation and expansion drill program on the vein system and these new targets.

ZAC is filling in gaps in work undergirding the historic estimate too. To that point, SGS Lakefield has been contracted to conduct a bench-scale metallurgical study of Panuco’s mineralization, the first such test work done on the project.

Much More Than Panuco

The expansive project contains the Muleros and El Cristo prospects also, in addition to a spate of relatively unexplored silver-base metal vein targets (El Oro, El Orito, La Canera, Monserrat, El Peñón, San Judas and San Juan) that will be a focus of rapid reconnaissance review to help inform go-forward plans. Of the group of relatively unexplored land, San Manuel-San Gill will be a focus of target generation work, as it is considered a robust gold target based on data from nine HQ diamond drill holes (3,176 meters) from 2006-2013.

Meanwhile, Muleros and El Cristo vein systems are a slightly better understood. Muleros is characterized by three sub-parallel, silver-gold-base metal mineralized veins which can be traced over a strike length of at least 3 kilometers. 37 HQ diamond drill holes (6,704 meters) were completed in 2007-2008 to evaluate shallow depths, with deeper potential unexplored.

Interestingly, there are historic mine shafts to the southeast of Muleros in an area now under extensive ground cover. The un-drilled ground will also be targeted as the historical shafts suggest the south vein extends a minimum of 1 kilometer in that direction.

Upside opportunity abounds Muleros, including gold grades from historical drill intercepts that are higher than other surrounding metal veins that need further exploration.

El Cristo has the company’s attention as it represents the northwest strike extension of the aforementioned Veta Grande vein system that was defining mineralization in the district nearly 450 years ago. The Veta Grande vein is reported to have produced over 200 million ounces of silver and El Cristo could be an extension of it. Eight silver-base metal veins are identified in El Cristo along a 3-kilometer strike length and 500 meters of width.

In 2010, the previous operator completed 8 HQ diamond drill holes totaling approximately 2,854 meters. The data showed elevated levels of lead and zinc and modest levels of silver and gold, resulting in drilling being abandoned. Zacatecas management is of the opinion that amount of limited drilling can’t effectively test an epithermal vein system of El Cristo’s length, particularly with respect to depth. The company intends to drill an initial 2,500 meters with expectations of a more extensive phase two drill program to learn for certain if El Cristo is indeed part of Veta Grande.

Well Heeled for Extensive Drilling

Zacatecas has over $9 million in cash to carry out extensive drill programs at the Panuco deposite, El Cristo and other strategic locations. Part of the capital came from a private company controlled by legendary mining investor and namesake to the Sprott Physical Silver Trust (NYSE: PSLV)(TSX: PSLV) Eric Sprott, who took a position of 2 million shares of ZAC, making him one of the Zacatecas’ largest shareholders.

Management is comprised of men steeped in experience building value for public companies in the mining space. This includes CEO and Director Bryan Slusarchuk, who previously co-founded K92 Mining Inc. He was with K92 from inception through to commercial production, and was instrumental in setting the stage for growth that led to K92 now having a $1.3 billion valuation, more than 900 employees and contractors and being name a OTCQX Best 50 company in 2020, as well as a 2020 TSX Venture 50 company.

Slusarchuk is aiming for a similar success with Zacatecas. He and the team have kept the share structure extremely tight in bringing the company public and looks properly aligned to grow long legs as the company starts to build value through the drill bit in a world class silver mining region with a world class team.

Legal Disclaimer/Disclosure: While all information is believed to be reliable, it is not guaranteed by us to be accurate. Individuals should assume that all information contained in our article is not trustworthy unless verified by their own independent research. Also, because events and circumstances frequently do not occur as expected, there will likely be differences between any predictions and actual results. Always consult a licensed investment professional before making any investment decision. Be extremely careful, investing in securities carries a high degree of risk; you may likely lose some or all of the investment. Furthermore, it is certainly possible for errors or omissions to take place regarding the profiled company, in communications, writing and/or editing. Nothing in this publication should be considered as personalized financial advice. We are not licensed under any securities laws to address your particular financial situation. No communication by our employees to you should be deemed as personalized financial advice. Please consult a licensed financial advisor before making any investment decision. This is a paid advertisement and is neither an offer nor recommendation to buy or sell any security. We hold no investment licenses and are thus neither licensed nor qualified to provide investment advice. The content in this article is not provided to any individual with a view toward their individual circumstances. Baystreet.ca has been paid a fee of twenty thousand dollars for Zacatecas Silver Corp. advertising by the company. There may be 3rd parties who may have shares of Zacatecas Silver Corp. and may liquidate their shares which could have a negative effect on the price of the stock. This compensation constitutes a conflict of interest as to our ability to remain objective in our communication regarding the profiled company. Because of this conflict, individuals are strongly encouraged to not use this article as the basis for any investment decision. By reading this communication, you agree to the terms of this disclaimer, including, but not limited to: releasing Baystreet.ca, its affiliates, assigns and successors from any and all liability, damages, and injury from the information contained in this communication. You further warrant that you are solely responsible for any financial outcome that may come from your investment decisions.