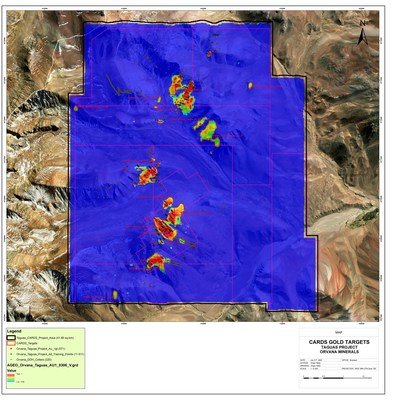

TORONTO, Sept. 14, 2020 /PRNewswire/ — Orvana Minerals Corp. (TSX: ORV) (the “Company” or “Orvana”) is providing an update on its exploration program at the Taguas mining property (“Taguas” or the “Property”) located in the San Juan province, Argentina. As a result of the completion of a recent artificial intelligence assisted data analysis, Orvana has identified a total of 17 new high probability gold targets at Taguas, consisting of 9 new areas and 8 extended areas of previous known mineralization. All of the newly identified targets are based on a 96% level of similarity to the known gold mineralization. These results suggest that there is an enhanced probability of increasing the potential of the Property’s oxides and sulphides resources. The potential of the new gold targets remains subject to additional fieldwork to be conducted the next summer season in Argentina. If COVID-19 restrictions allow, the field work campaign will include opening new access points, surface mapping and soil and rock sampling.

Orvana retained Windfall Geotek (“Windfall”), a TSXV-listed company, to analyze existing Taguas data in connection with the development of the gold exploration targets at Taguas. Utilizing its Computer Aided Resources Detection System (“CARDS”), Windfall processed the geophysical, geochemical, and geological data provided by Orvana to analyze the patterns hidden in the large amount of existing data, which consisted of a drill hole database containing 220 drill holes, a surface samples database containing 854 samples, and Magnetic (TMI) and Radiometric (K, Th, U & TC) data at 10m resolution (417,716 datapoints). The public SRTM (Shuttle Radar Topography Mission) data was also used to characterize the topography.

Mr. Raúl Álvarez, Head of Exploration of Orvana, stated: “We are excited about the identification of the 17 new gold targets, which, if confirmed through additional fieldwork, will materially increase the potential upside of Taguas. Field work planned for the following months will provide key information to optimize the definition of the next drilling campaign”. Mr. Álvarez added that “The Company is taking advantage of new technologies to optimize the exploration programs and reduce costs, while advancing the project despite COVID-19 restrictions”.

The new gold exploration targets that have been identified, are represented as red shapes in Figure 1.

Background of the Taguas Mining Property

On May 14, 2019, Orvana entered into a purchase agreement with Compañía Minera Taguas S.A. pursuant to which Orvana agreed to acquire the Taguas property located in the Province of San Juan, Argentina. Closing of the transaction is subject to applicable local mining rights registrations and the final acceptance of the Toronto Stock Exchange. The process to complete the acquisition and registration of the Taguas Project in Argentina has been delayed due to COVID-19 travel restrictions and national lockdown measures. The Company is not in a position to determine a timeline to complete the registration of the acquisition of the Taguas Project in Argentina until the COVID-19 restrictions are lifted.

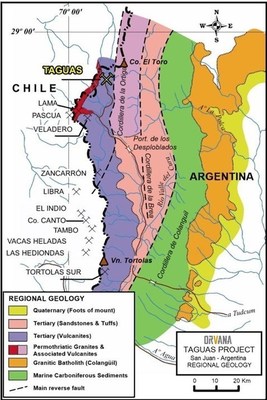

Taguas is located at the northern end of the Tertiary-age Valle del Cura volcanic belt in Argentina (Figure 2) and on the eastern flank of the El Indio metallogenic belt1. The Valle Del Cura belt has a similar basement, comparable volcanism ages and alteration as the volcanism on the Chilean side2 and constitutes an extension of the El Indio belt into Argentina.

Taguas consists of 15 mining concessions over an area of 3,273.87 ha. The Property is located in the Province of San Juan, Argentina, on the eastern flank of the Andes, between 3,500 m to 4,300 m above sea level. The Property is host to a high-sulfidation epithermal gold-silver system hosted in altered tertiary age rhyolite volcaniclastic rocks. Supergene-oxidized gold-silver mineralization occurs on the south half of the Property.

On July 9, 2019 the Company filed a Preliminary Economic Assessment Report for the Taguas property (the “PEA”). A copy of the PEA may be obtained on the Company’s profile at www.sedar.com. The PEA refers only to the oxidized gold-silver mineralization occurring near surface known at the date of the report, consisting of sub-vertical, northeast striking mineralized structures in an envelope of lower grade mineralization. The high-grade zones consist of relatively continuous mineralization with gold grades ranging from 0.2 g/t Au to over 4.0 g/t Au and 10 g/t Ag to over 50 g/t Ag. Oxidation extends from surface to approximately 100m – 200m below surface. The PEA utilized the following inferred mineral resource:

Estimate of Inferred Mineral Resource reported at 0.25 g/t AuEq Cut-off

|

COG g/t AuEq |

Tonnes Mt |

Au g/t |

Ag g/t |

AuEq g/t |

Contained Metal |

|

|

Au koz |

Ag koz |

|||||

|

0.20 |

49.6 |

0.35 |

12.7 |

0.45 |

556 |

20,237 |

|

0.25 |

38.6 |

0.40 |

14.6 |

0.51 |

494 |

18,110 |

|

0.30 |

30.0 |

0.45 |

16.5 |

0.58 |

435 |

15,894 |

|

Notes: |

|

1. Mineral Resource estimate prepared by Mr. R. Simpson, P.Geo., of GeoSim Services Inc. with an effective date of 14 May 2019. Mineral Resources are classified using the 2014 CIM Definition Standards. |

|

2. Gold equivalent (AuEq g/t) calculations were based on assumed metal prices of $1300/oz Au, and $17/oz Ag, recoveries of 87% Au and 52% Ag. AuEq = Au(g/t) + Ag(g/t) *0.0078 |

|

3. An optimized pit shell was generated using the following assumptions: metal prices/recoveries in Note 2 above; a 45° pit slope; mining costs of $2.00 per tonne, processing costs of $5.20 per tonne, and general & administrative charges of $1.50 per tonne. All amounts are expressed in US dollars. |

|

4. Totals may not sum due to rounding. |

|

5. Mineral Resources are not Mineral Reserves and do not have demonstrated economic viability. |

Mineral resources that are not mineral reserves do not have demonstrated economic viability. The PEA is preliminary in nature and includes inferred mineral resources that are considered too speculative geologically to have the economic considerations applied to them that would enable them to be categorized as mineral reserves and there is no certainty that the results of the PEA will be realized. The financial analysis in the PEA does not include the 2.5% royalty associated with the acquisition of the Property by Orvana. The PEA study is conceptual in nature and the PEA mine plan is based on 100% inferred resources. The projections, forecasts and estimates presented in the PEA constitute forward-looking statements and readers are urged not to place undue reliance on such forward-looking statements. Additional cautionary and forward-looking statement information is detailed at the end of this news release.

About Orvana Minerals

Orvana is a multi-mine gold-copper-silver company. Orvana’s assets consist of the producing El Valle and Carlés gold-copper-silver mines in northern Spain and the Don Mario gold-silver property in Bolivia, currently in care and maintenance. Additional information is available at Orvana’s website (www.orvana.com).

Cautionary Statements – Forward-Looking Information

Certain statements made herein constitute forward-looking statements or forward-looking information within the meaning of applicable securities laws (“forward-looking statements”). Any statements that express or involve discussions with respect to predictions, expectations, beliefs, plans, projections, objectives, assumptions, potentials, future events or performance (often, but not always, using words or phrases such as “believes”, “expects”, “plans”, “estimates”, “intends” or “anticipates” or stating that certain actions, events or results “may”, “could”, “would”, “might”, “will” or “are projected to” be taken or achieved) are not statements of historical fact, but are forward-looking statements.

The forward-looking statements herein relate to, among other things, the potential impact of the COVID-19 on our the Company’s business and operations, including our its ability to continue operations; our the Company’s ability to manage challenges presented by COVID-19; the accounting treatment of COVID-19 related matters; Orvana’s ability to prevent and/or mitigate the impact of COVID-19 and other infectious diseases at or near the Company’s mines and support the sustainability of its business including through the development of crisis management plans, increasing stock levels for key supplies, monitoring of guidance from the medical community, and engagement with local communities and authorities; Orvana’s ability to achieve improvement in free cash flow; the potential to extend the mine life of El Valle and Don Mario beyond their current life-of-mine estimates including specifically, but not limited to in the case of Don Mario, the processing of the mineral stockpiles and the reprocessing of the tailings material; Orvana’s ability to optimize its assets to deliver shareholder value; the Company’s ability to optimize productivity at Don Mario and El Valle; estimates of future production, operating costs and capital expenditures; mineral resource and reserve estimates; statements and information regarding future feasibility studies and their results; future transactions; future metal prices; the ability to achieve additional growth and geographic diversification, including without limitation, the ability to complete the acquisition of the Taguas Property; future financial performance, including the ability to increase cash flow and profits; and future financing requirements and mine development plans.

Forward-looking statements are necessarily based upon a number of estimates and assumptions that, while considered reasonable by the Company as of the date of such statements, are inherently subject to significant business, economic and competitive uncertainties and contingencies as particularly set out in the notes accompanying the Company’s most recently filed financial statements. The estimates and assumptions of the Company contained or incorporated by reference in this news release, which may prove to be incorrect, include, but are not limited to, the accuracy of the data analysis provided by Windfall Geotek, the various assumptions set forth herein and in Orvana’s most recently filed Management’s Discussion & Analysis and Annual Information Form in respect of the Company’s most recently completed fiscal year (the “Company Disclosures”) or as otherwise expressly incorporated herein by reference as well as: there being no significant disruptions affecting operations, whether due to labour disruptions, supply disruptions, power disruptions, damage to equipment or otherwise; permitting, development, operations, expansion and acquisitions at El Valle and Don Mario being consistent with the Company’s current expectations; political developments in any jurisdiction in which the Company operates being consistent with its current expectations; certain price assumptions for gold, copper and silver; prices for key supplies being approximately consistent with current levels; production and cost of sales forecasts meeting expectations; the accuracy of the Company’s current mineral reserve and mineral resource estimates; and labour and materials costs increasing on a basis consistent with Orvana’s current expectations.

A variety of inherent risks, uncertainties and factors, many of which are beyond the Company’s control, affect the operations, performance and results of the Company and its business, and could cause actual events or results to differ materially from estimated or anticipated events or results expressed or implied by forward looking statements. Some of these risks, uncertainties and factors include fluctuations in the price of gold, silver and copper; the need to recalculate estimates of resources based on actual production experience; the failure to achieve production estimates; variations in the grade of ore mined; variations in the cost of operations; the availability of qualified personnel; the Company’s ability to obtain and maintain all necessary regulatory approvals and licenses; the Company’s ability to use cyanide in its mining operations; risks generally associated with mineral exploration and development, including the Company’s ability to continue to operate the El Valle and/or Don Mario and/or ability to resume long-term operations at the Carlés Mine; the Company’s ability to successfully implement a sulphidization circuit and ancillary facilities to process the current oxides stockpiles at Don Mario; the Company’s ability to acquire and develop mineral properties and to successfully integrate such acquisitions; the Company’s ability to execute on its strategy; the Company’s ability to obtain financing when required on terms that are acceptable to the Company; challenges to the Company’s interests in its property and mineral rights; current, pending and proposed legislative or regulatory developments or changes in political, social or economic conditions in the countries in which the Company operates; general economic conditions worldwide; and the risks identified in the Company’s disclosures. This list is not exhaustive of the factors that may affect any of the Company’s forward-looking statements and reference should also be made to the Company’s Disclosures for a description of additional risk factors.

Any forward-looking statements made herein with respect to the anticipated development and exploration of the Company’s mineral projects are intended to provide an overview of management’s expectations with respect to certain future activities of the Company and may not be appropriate for other purposes.

Forward-looking statements are based on management’s current plans, estimates, projections, beliefs and opinions and, except as required by law, the Company does not undertake any obligation to update forward-looking statements should assumptions related to these plans, estimates, projections, beliefs and opinions change. Readers are cautioned not to put undue reliance on forward-looking statements.

______________________________

1 Siddeley, G. and Araneda, R., (1990). Gold-silver Occurrences of the El Indio Belt, Chile: Circum-Pacific Council Energy Mineral Resources, Volume 11, pages 273-284.

2 Davidson, J. and Mpodozis, C., (1991). Regional Geologic Setting of Epithermal Gold Deposits Chile: Economic Geology, Volume 86, pages 1174-1186.

Photo – https://mma.prnewswire.com/media/1273477/Orvana_Minerals_Corp__Orvana_Identifies_17_New_High_Probability.jpg

Photo – https://mma.prnewswire.com/media/1273478/Orvana_Minerals_Corp__Orvana_Identifies_17_New_High_Probability.jpg