With gold trading at an all-time high, and legendary investor Warren Buffet backing the precious metal for the first time, it’s definitely time to consider where the next big gold discovery will emerge.

And chances are it will be the same country that Buffett just bet on: Canada.

Buffett wasn’t betting on discovery though, instead, he was betting on dividends. But dividends are for small, steady returns over a long period of time.

But for investors looking for big returns, small-cap miners are where the risk-reward potential gets interesting.

Especially when it’s a small-cap miner like Starr Peak Exploration Ltd. (TSXV:STE; OTC:STRPF) that was prescient enough to place itself right next to a huge gold discovery – before it happened.

And now the company is doubling down with major new acquisitions in the heart of one of the friendliest mining regions in the world.

The smart money is already circling the stock, with Starr Peak’s shares on a tear, gaining over 900% in 12 months:

Source: TMX Money

Even Buffett Believes The Time Is Right For Canadian Gold

Buffett broke with his long-held negative stance on gold on August 17th when his Berkshire Hathaway disclosed a massive stake in Canadian Barrick Gold (NYSE:GOLD) at a time when gold is soaring.

Berkshire Hathaway bought more than $560 million in Barrick Gold shares.

Buffett has always called gold useless for the most part.

But with COVID-19 ravaging the economy, even if the dollar makes a few temporary comebacks, gold is on track for a 90% increase in a very short time frame. That makes gold one of the biggest opportunities in the past few months.

Still, holding gold-mining stocks isn’t the same as holding physical gold, which is largely just a safe haven hedge against inflation – and nothing more. Buffett didn’t buy gold. He bought GOLD.

Gold-mining stocks come with much bigger potential rewards, but the biggest risks and rewards of all are the small-cap stocks that are sitting on new potential resources that nobody knows about.

That’s where small-cap Starr Peak Exploration Ltd. (TSXV:STE; OTC:STRPF) shines in that sweet spot right between a major discovery and low exposure.

The company is now trying to replicate a huge discovery made by its neighbor – Amex Exploration, whose own shares surged over 2,000% in the last year on new gold discoveries, and over 1000% in the last 12 months alone.

And it’s right in the heart of what is arguably the best gold venue in the world …

Canadian Gold and the Quebec Heartland

The future is bright for gold miners in Quebec, with a rich precious metals history and still a ton of unexplored and underexplored territory.

And it’s got geology that makes the mining industry reel with anticipation. More than 90% of the province’s substratum consists of Precambrian rock, which is famous for rich deposits of gold – as well as iron, copper, and nickel.

That’s why the province has at least 30 major mines and some 160 exploration projects. And that is with only around 40% of the province’s mineral potential even known.

The biggest prize is the Abitibi Greenstone Belt, home to some of the world’s largest gold and base metal deposits. These are “world-class” deposits – a dozen of them, including the recent giant discovery by Amex. And Starr Peak is working to repeat Amex’s success.

When gold soars, the first – and biggest – beneficiaries are those stocks on Canada’s main index, the Toronto Stock Exchange (TSX). And it’s been a phenomenal 2020 for these stocks. And the best way to look for the surges is what’s coming out of Quebec.

Right now, we’re looking at the best conditions ever for new high-value gold discoveries. The soaring optimism has market values climbing uproariously since March for an entire lineup of Canadian miners, including Osisko Mining (TSX:OSK), IAMGOLD Corporate (NYSE:IAG), McEwen Mining Inc. (NYSE:MUX), and many others.

After years of cost-cutting, gold miners are now ready to spend, spend, spend on exploration – globally.

But what’s happened is this: Mining majors have largely given up exploration, standing by to let the junior miners do all the heavy lifting and then scooping them up on a major discovery, or once a discovery has been proved up. That makes some junior mining stocks worth far more than their market caps. And it makes millionaires out of some of their investors.

And Quebec is one of the friendliest, most lucrative gold-mining venues in the world. This isn’t African gold, with the uncertainty of corruption and the lack of infrastructure. This is a superior mining country with massive infrastructure already in place.

Welcome to the Discovery Zone: Past, Present & Future

Starr Peak acquired its first property directly adjacent and joining Amex’s property back in June 2019.

That was prescient because it was done before Amex made its first big discovery, and even before it started drilling aggressively.

Anytime later and that would have been prime real estate with a prime price. Which is what it is, precisely, now.

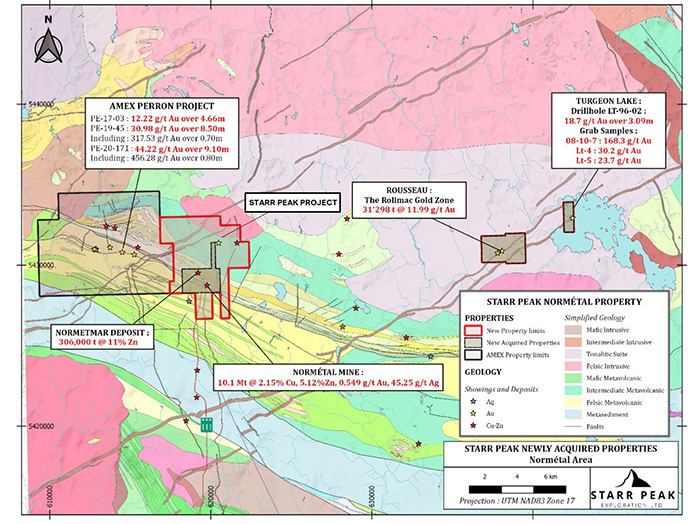

Figure 1: Geological Map of the NewMetal property with the new acquired claims blocs with respect to Amex Exploration’s Perron Project.

Starr Peak’s NewMétal Property is immediately east of AMEX’s Perron Property, and also hosts the past-producing Normétal Mine, which Starr Peak just acquired on August 10th 2020.

The acquisition hunger here has been incredibly aggressive. Even though Starr Peak and its early staged investors were already confident that the company was sitting on an Amex-style re-run, they still moved fast to keep expanding their position.

It’s been a series of acquisitions over the past 12 months, including a huge package that looks like a pincer movement around Quebec’s best-positioned gold play.

In June 2020, it expanded the first property by strategically acquiring a property that almost doubled its existing land position next to the world class deposit discovered by Amex.

There were dozens of companies trying to get their hands on the property, but Starr Peak already had a leg up in the area.

Then, in August, Starr Peak acquired a 100%-interest in three major gold properties, orchestrating what can only be described as a mining coup for a small-cap company like this:

– The Normetal/Normetmar gold, copper, zinc and silver property

– The Rousseau gold property

– The Turgeon Lake gold property

Starr Peak now has 74 mineral claims on some 2,280 hectares in one of the world’s most exciting gold plays.

As we speak, Amex is drilling closer and closer to Starr Peak’s property line–and the closer it gets, the higher the grades of gold and the shallower the depth.

Right now, it’s only about 1.2 kilometers away from Starr Peak.

And Starr Peak is fully funded and ready to start drilling its own property, with the same top geological consulting firm in Quebec, Laurentia Exploration–the same one behind the Amex discovery–to ramp it up.

These are exciting times in the Canadian gold patch, and nowhere is more exciting than the untapped precious metals potential of the world’s favorite gold province–Quebec. This is where giant discoveries have a past, a present, and an even bigger future. If Normetal was a major player, and Amex a story of wild returns for investors, Starr Peak may be next in line.

Other companies set to benefit from record-high gold prices:

Yamana Gold (TSX:YRI) Yamana, has recently completed its Cerro Moro project in Argentina, giving its investors something major to look out for. The company ramped up its gold production by 20% through 2019 and its silver production by a whopping 200%. Investors can expect a serious increase in free cash flow if precious metal prices remain stable.

Recently, Yamana signed an agreement with Glencore and Goldcorp to develop and operate another Argentinian project, the Agua Rica. Initial analysis suggests the potential for a mine life in excess of 25 years at average annual production of approximately 236,000 tonnes (520 million pounds) of copper-equivalent metal, including the contributions of gold, molybdenum, and silver, for the first 10 years of operation.

The agreement is a major step forward for the Agua Rica region, and all of the miners working on it.

Eldorado Gold Corp. (TSX:ELD) is a mid-cap miner with assets in Europe and Brazil. It has managed to cut cost per ounce significantly in recent years. Though its share price isn’t as high as it once was, Eldorado is well positioned to make significant advancements in the near-term.

In 2018, Eldorado produced over 349,000 ounces of gold, well above its previous expectations, and boosted its production even further in 2019.

Eldorado’s President and CEO, George Burns, stated: “As a result of the team’s hard work in 2018, we are well positioned to grow annual gold production to over 500,000 ounces in 2020. We expect this will allow us to generate significant free cash flow and provide us with the opportunity to consider debt retirement later this year. “

First Majestic Silver (TSX:FR)

Though First Majestic recently took a significant blow, as a strong dollar weighed on precious metals resulting in a poor quarterly earnings report, there’s still a lot of bullishness surrounding the stock. Adding to the negative numbers, however, was a string of highly valuable acquisitions which are likely to turn around for the metals giant in the mid-to-long-term.

While it’s primary focus remains on silver mining, it does hold a number of gold assets, as well. Additionally, silver tends to follow gold’s lead when wider markets begin to look shaky. And with analysts sounding the alarms of a global economic slowdown, both metals are likely to regain popularity among investors.

Wheaton Precious Metals Corp. (TSX:WPM)

Wheaton is a company with its hands in operations all around the world. As one of the largest ‘streaming’ companies on the planet, Wheaton has agreements with 19 operating mines and 9 projects still in development. Its unique business model allows it to leverage price increases in the precious metals sector, as well as provide a quality dividend yield for its investors.

Recently, Wheaton sealed a deal with Hudbay Minerals Inc. relating to its Rosemont project. For an initial payment of $230 million, Wheaton is entitled to 100 percent of payable gold and silver at a price of $450 per ounce and $3.90 per ounce respectively.

Randy Smallwood, Wheaton’s President and Chief Executive Officer explained, “With their most recent successful construction of the Constancia mine in Peru, the Hudbay team has proven themselves to be strong and responsible mine developers, and we are excited about the same team moving this project into production. Rosemont is an ideal fit for Wheaton’s portfolio of high-quality assets, and when it is in production, should add well over fifty thousand gold equivalent ounces to our already growing production profile.”

Pan American Silver (TSX:PAAS)

Pan American is a world-class mining operation with active projects in Mexico, Peru, Canada, Bolivia and Argentina. Though silver has seen better days, it is still a favorite among investors stocking up on safe haven assets.

Recently, Pan American made a major acquisition of Tahoe Resources, absorbing the company’s issued and outstanding shares.

Michael Steinmann, President and Chief Executive Officer of Pan American Silver, said: “The completion of the Arrangement establishes the world’s premier silver mining company with an industry-leading portfolio of assets, a robust growth profile and attractive operating margins. We are also now the largest publicly traded silver mining company by free float, offering silver mining investors enhanced scale and liquidity.”

By. Rick Sonenshein

**IMPORTANT! BY READING OUR CONTENT YOU EXPLICITLY AGREE TO THE FOLLOWING. PLEASE READ CAREFULLY**

Forward-Looking Statements / This news release contains forward-looking information which is subject to a variety of risks and uncertainties and other factors that could cause actual events or results to differ from those projected in the forward-looking statements. Forward looking statements in this release include that prices for gold will retain value in future as currently expected; that Starr Peak can fulfill all its obligations to acquire its Quebec property, including receiving stock exchange approval; that Starr Peak’s Quebec property can achieve drilling and mining success for gold; that historical geological information and estimations will prove to be accurate; that high-grade targets exist; and that Starr Peak will be able to carry out its business plans. These forward-looking statements are subject to a variety of risks and uncertainties and other factors that could cause actual events or results to differ materially from those projected in the forward-looking information. Risks that could change or prevent these statements from coming to fruition include that the Company may not get TSXV approval; it may not be able to finance its intended drilling program; Starr Peak may not raise sufficient funds to carry out its plans; geological interpretations and technological results based on current data that may change with more detailed information or testing. The forward-looking information contained herein is given as of the date hereof and the Company assumes no responsibility to update or revise such information to reflect new events or circumstances, except as required by law.

DISCLAIMERS

This communication is for entertainment purposes only. Never invest purely based on our communication. We have not been compensated by Starr Peak but may in the future be compensated to conduct investor awareness advertising and marketing for TSXV:STE. The information in our communications and on our website has not been independently verified and is not guaranteed to be correct.

SHARE OWNERSHIP. The owner of Oilprice.com owns shares of this featured company and therefore has an additional incentive to see the featured company’s stock perform well. The owner of Oilprice.com will not notify the market when it decides to buy more or sell shares of this issuer in the market. The owner of Oilprice.com will be buying and selling shares of this issuer for its own profit. This is why we stress that you conduct extensive due diligence as well as seek the advice of your financial advisor or a registered broker-dealer before investing in any securities.

NOT AN INVESTMENT ADVISOR. The writer of this article is not registered or licensed by any governing body in any jurisdiction to give investing advice or provide investment recommendation. ALWAYS DO YOUR OWN RESEARCH and consult with a licensed investment professional before making an investment. This communication should not be used as a basis for making any investment.

RISK OF INVESTING. Investing is inherently risky. Don’t trade with money you can’t afford to lose. This is neither a solicitation nor an offer to Buy/Sell securities. No representation is being made that any account will or is likely to achieve profits similar to those discussed.