VANCOUVER, BC, Aug. 18, 2020 /PRNewswire/ – KORE Mining Ltd. (TSXV: KORE) (OTCQX: KOREF) (“KORE” or the “Company“) has commenced work on a Preliminary Economic Assessment (“PEA”) of the Long Valley project (“Project” or “Long Valley“) located in Mono County California. Engineering is well advanced, with results expected in late Q3 2020.

Scott Trebilcock, President and CEO stated, “Long Valley is a large, shallow gold deposit with great oxide heap leach metallurgy. The Long Valley PEA will come as an important milestone for Kore as we continue to extract value out of our advanced heap leach projects in the United States. The Imperial PEA was a significant catalyst for KORE and we expect the Long Valley PEA will continue to demonstrate the quality of our world-class assets.”

Mr. Trebilcock continued, “The Long Valley PEA will also demonstrate why KORE is allocating capital to the Long Valley deposit, which remains open for exploration in shallow oxides and for new sulphide discoveries. KORE has the funding to advance our assets, deliver catalysts and take advantage of the strong gold market.”

The PEA will scope an open pit mine with heap leach processing of oxide and transition materials. The Project is expected to benefit from nearby skilled labour, major highways and power infrastructure. Long Valley has extensive oxide metallurgical testing which showed the oxide and transition materials are amenable to heap leaching and has the potential for high recoveries. The shallow nature of the deposit will enable full compliance with California’s stringent reclamation requirements including backfilling in the PEA.

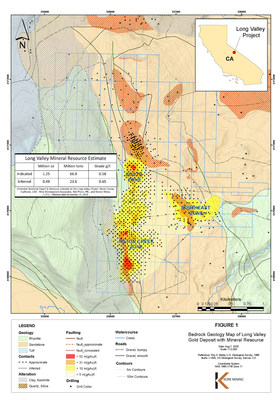

The current mineral resource estimate is 1,247,000 ounces of Indicated gold and 486,000 ounces of Inferred gold from 66.8 million tonnes of 0.58 grams per tonne and 23.6 million tonnes of 0.65 grams per tonne, respectively. The mineral resource consists of oxide, transition and sulphides. The estimate was prepared by Neil Prenn, P.E., and Steven Weiss, C.P.G. of Mine Development Associates with an effective date of November 15, 2019. More information is available in the technical report filed on www.sedar.com and on KORE’s website at www.koremining.com.

Long Valley was historically assayed almost exclusively for gold. The limited silver assays on the project showed up to 10 times the gold grade in silver. This represents a future upside for the project that will not be included in the PEA, but will likely be incorporated in future resource updates and reported with new drilling.

On January 30, 2020 and March 24, 2020, KORE announced results from several rounds of ground geophysics, soil sampling and rock sampling at Long Valley. The work generated multiple drill targets to grow shallow oxide mineralization, opening the deposit to growth on-strike and laterally. The geophysics also generated clear sulphide feeder structure drill targets to make new discoveries at depth and open a new frontier for exploration at the Project. Sulphide potential is further highlighted by the fact that 44% of historic drill holes ended in gold mineralization exceeding the cut-off grade of the deposit, with bottom hold grades as high as 4.8 grams per tonne.

Permitting for drill testing highest priority targets is underway.

About Long Valley Gold Project

Long Valley is a 100% owned gold project located in Mono County, California – see Figure 1. Within the Project, is the Long Valley deposit, an intact epithermal gold deposit (“Deposit”) with a shallow, large 2.5 by 2 kilometer oxide gold footprint. A total of 896 holes have been drilled on the Project, the majority being completed by reverse circulation with lesser core, rotary and air track. The average depth of drilling is less than 90 meters below surface. Figure 1 shows the claims, drill collar locations and mineralized area.

About KORE Mining Ltd.

KORE is 100% owner of a portfolio of advanced gold exploration and development assets in California and British Columbia. KORE, supported by strategic investors Eric Sprott and Macquarie Bank; and insiders, including management and Board, own 64% of the basic shares outstanding. Further information on KORE and its assets can be found on the Company’s website at www.koremining.com and at www.sedar.com, or by contacting us as info@koremining.com or by telephone at (888) 407-5450.

On behalf of KORE Mining Ltd

“Scott Trebilcock”

Chief Executive Officer

(888) 407-5450

Investor Relations

Arlen Hansen, KIN Communications

1-888-684-6730

kore@kincommunications.com

Technical information with respect to the Imperial deposit and project contained in this news release has been reviewed and approved by Marc Leduc, P.Eng., who is KORE’s designated qualified person under National Instrument 43-101 for the purposes of this news release.

This news release does not constitute an offer to sell or a solicitation of an offer to sell any KORE common shares in the United States.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Cautionary Statement Regarding Forward-Looking Information

This news release contains forward-looking statements relating to the future operations of the Company and other statements that are not historical facts. Forward-looking statements are often identified by terms such as “will”, “may”, “should”, “anticipate”, “expects”, “intends”, “indicates” and similar expressions. All statements other than statements of historical fact, included in this release, including, without limitation, statements regarding the future plans and objectives of the Company are forward-looking statements. Forward-looking statements in this news release include, but are not limited to, statements with respect to: the potential gold structures at the District deposits, next steps and timing regarding follow-up programs at the District, results of the PEA, including future Project opportunities, future operating and capital costs, closure costs, AISC, the projected NPV, IRR, timelines, permit timelines, and the ability to obtain the requisite permits, economics and associated returns of the Imperial Project, the technical viability of the Imperial Project, the market and future price of and demand for gold, the environmental impact of the Imperial Project, and the ongoing ability to work cooperatively with stakeholders, including the local levels of government. Such forward-looking statements, and any assumptions upon which they are based, are made in good faith and reflect our current judgment regarding the direction of our business. Management believes that these assumptions are reasonable. Forward looking information involves known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements of the Company to be materially different from any future results, performance or achievements expressed or implied by the forward-looking information.

Such factors include, among others: risks related to exploration and development activities at the Company’s projects, and factors relating to whether or not mineralization extraction will be commercially viable; risks related to mining operations and the hazards and risks normally encountered in the exploration, development and production of minerals, such as unusual and unexpected geological formations, rock falls, seismic activity, flooding and other conditions involved in the extraction and removal of materials; uncertainties regarding regulatory matters, including obtaining permits and complying with laws and regulations governing exploration, development, production, taxes, labour standards, occupational health, waste disposal, toxic substances, land use, environmental protection, site safety and other matters, and the potential for existing laws and regulations to be amended or more stringently implemented by the relevant authorities; uncertainties regarding estimating mineral resources, which estimates may require revision (either up or down) based on actual production experience; risks relating to fluctuating metals prices and the ability to operate the Company’s projects at a profit in the event of declining metals prices and the need to reassess feasibility of a particular project that estimated resources will be recovered or that they will be recovered at the rates estimated; risks related to title to the Company’s properties, including the risk that the Company’s title may be challenged or impugned by third parties; the ability of the Company to access necessary resources, including mining equipment and crews, on a timely basis and at reasonable cost; competition within the mining industry for the discovery and acquisition of properties from other mining companies, many of which have greater financial, technical and other resources than the Company, for, among other things, the acquisition of mineral claims, leases and other mineral interests as well as for the recruitment and retention of qualified employees and other personnel; access to suitable infrastructure, such as roads, energy and water supplies in the vicinity of the Company’s properties; and risks related to the stage of the Company’s development, including risks relating to limited financial resources, limited availability of additional financing and potential dilution to existing shareholders; reliance on its management and key personnel; inability to obtain adequate or any insurance; exposure to litigation or similar claims; currently unprofitable operations; risks regarding the ability of the Company and its management to manage growth; and potential conflicts of interest.

In addition to the above summary, additional risks and uncertainties are described in the “Risks” section of the Company’s management discussion and analysis for the year ended December 31, 2019 prepared as of April 27, 2020 available under the Company’s issuer profile on www.sedar.com.

Forward-looking statements contained herein are made as of the date of this news release and the Company disclaims any obligation to update any forward-looking statements, whether as a result of new information, future events or results, except as may be required by applicable securities laws. There can be no assurance that forward-looking information will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Accordingly, readers should not place undue reliance on forward-looking information.

The Imperial PEA is preliminary in nature, it includes inferred mineral resources that are considered too speculative geologically to have the economic considerations applied to them that would enable them to be categorized as mineral reserves, and there is no certainty that the Imperial PEA will be realized. There is no certainty that all or any part of the mineral resource will be converted into mineral reserve. It is uncertain if further exploration will allow improving the classification of the Indicated or Inferred mineral resource. Mineral resources are not mineral reserves and do not have demonstrated economic viability.

Cautionary Note Regarding Mineral Resource Estimates: Information regarding mineral resource estimates has been prepared in accordance with the requirements of Canadian securities laws, which differ from the requirements of United States Securities and Exchange Commission (“SEC”) Industry Guide 7. In October 2018, the SEC approved final rules requiring comprehensive and detailed disclosure requirements for issuers with material mining operations. The provisions in Industry Guide 7 and Item 102 of Regulation S-K, have been replaced with a new subpart 1300 of Regulation S-K under the United States Securities Act and will become mandatory for SEC registrants after January 1, 2021. The changes adopted are intended to align the SEC’s disclosure requirements more closely with global standards as embodied by the Committee for Mineral Reserves International Reporting Standards (CRIRSCO), including Canada’s NI 43-101 and CIM Definition Standards. Under the new SEC rules, SEC registrants will be permitted to disclose “mineral resources” even though they reflect a lower level of certainty than mineral reserves. Additionally, under the New Rules, mineral resources must be classified as “measured”, “indicated”, or “inferred”, terms which are defined in and required to be disclosed by NI 43-101 for Canadian issuers and are not recognized under SEC Industry Guide 7. An “Inferred Mineral Resource” has a lower level of confidence than that applying to an “Indicated Mineral Resource” and must not be converted to a Mineral Reserve. It is reasonably expected that the majority of “Inferred Mineral Resources” could be upgraded to “Indicated Mineral Resources” with continued exploration. Accordingly, the mineral resource estimates and related information may not be comparable to similar information made public by United States companies subject to the reporting and disclosure requirements under the United States federal laws and the rules and regulations thereunder, including SEC Industry Guide 7.

![]() View original content to download multimedia:http://www.prnewswire.com/news-releases/kore-mining-launches-preliminary-economic-assessment-for-long-valley-gold-project-301113657.html

View original content to download multimedia:http://www.prnewswire.com/news-releases/kore-mining-launches-preliminary-economic-assessment-for-long-valley-gold-project-301113657.html

SOURCE Kore Mining