In 2004 Marc Levy founded Norsemont Mining, a company then trading at 5 cents with about $1 million market capitalization. The company acquired and developed the Constancia project, a large copper porphyry asset in South America (Peru) from Rio Tinto (NYSE: RIO), and–much to its shareholders’ delight– sold it by 2011 to Hudbay (T:HBM) for $520 million. Today, a reincarnated, reinvigorated Norsemont Mining (CSE: NOM, OTC: NRRSF) is unveiling exactly what its next new asset is: a past-producing gold and silver project that has about $100 million of work already sunk into it, complete with a perfectly functional, scalable and permitted mine, and enough exploration drilling to define a 5.5 million plus ounce gold deposit – and that’s just to start.

No stranger to Chile and doing deals with majors, Norsemont acquired a 100% interest in the Choquelimpie gold/silver project in northern Chile from a subsidiary of the $7.5 billion Chilean conglomerate Empresas Copec (BCS: COPEC). Norsemont essentially “stole” the asset—already boasting a (non NI-43-101 complaint) 2017 internal resource estimate of 5.5 million ounce of gold equivalent—for US $3.3 million and 15 million shares. How did this happen? Copec, as a multi-billion dollar giant has even bigger fish to fry and is focused on its almost $1 billion investment in a major copper project in Peru. The group which controlled the asset saw it could best participate in an improved valuation of Choquilimpie by allowing a proven exploration and mining team to de-risk and develop that asset. “They were more interested in an equity position than the cash, because they know they can leverage a tremendous potential upside of this asset,” says Norsemont CEO Allan Larmour. “They wanted a group that could raise the capital and develop the project to its full potential.”

Norsemont added to its already gold-level credibility in Chile by creating an advisory board chaired by David Laing, a mining engineer with 40 years of experience in the industry, who is no stranger to Chile or to the Choquelimpie project directly. Laing was mine and plant superintendent with SCM Vilacollo, which was the joint venture vehicle that the previous owners, Shell and partners, used to put the Choquelimpie gold-silver project into production and made it the 3rd largest gold producer in Chile from 1988-1992. This was all before his time as COO of Equinox Gold, with gold projects in Brazil and California, COO of True Gold Mining which developed a gold heap leaching operation in Burkina Faso, and COO and EVP of Quintana Resources Capital, a base metals streaming company. He was also one of the original executives of Endeavour Mining, a gold producer in West Africa. He is currently a director of Fortuna Silver Mines and has advised over $25 billion worth of M&A and investments in resource projects over his career. Larmour says other heavy-hitting additions to the team are soon to come.

As far as a mining jurisdiction goes it doesn’t get much better than Chile. All of the majors – and potential suitors for a de-risked gold, silver or copper project – are there: Barrick, Antofagasta, Yamana, Rio Tinto, Anglo American and BHP to name a few.

The Choquelimpie Gold project is located in the Arica and Parinacota Region of northern Chile. There is excellent year-round access to the 5,757-hectares project, with power and water (with permits) on the site, an ADR effluent treatment plant, a fully-operational 3,000 tonnes per day (tpd) mill on the site surrounded by a fully-equipped camp, offices, warehouse and lab for sample preparation. You could say it is a turnkey operation just waiting for more ore. And that is what Norsemont plans to give it.

In its heyday, this 3,000 tpd ‘smaller’ mine produced about 380,000 ounces of gold at a high grade (for an open pit) of 2.23 grams per ton (g/t Au) all oxide gold (oxide is cheaper to process) from ’88-’92, nearly 100,000 ounces per year. But Larmour and company see a much, much bigger operation, and they already have the data to prove it, which will soon bring it up to NI-43-101 standards.

The project comes with a historical estimate (non-NI-43-101 compliant) released by Amec Foster Wheeler in 2017. That estimate includes 4.1 million ounces of gold grading 0.58 g/t gold and 62.5 million ounces of silver at 8.88 g/t Ag for approximately 5.5 million gold-equivalent ounces. Notably, the historic exploration only covers an area of 5 square kilometres in an area showing 27 Km2 of hydrothermal alteration. The historic drilling just went as deep as 70 metres using reverse circulation drilling, which only provides ‘busted-up’ chips for evaluation. “When we use core drilling to depths of 250 metres we should get better recovery grades and we’ll have a much better understanding of the mineralizing structures and orientation and all drilling ended in mineralization, which could ultimately lead to a much larger resource. As well, the project is open at strike and we have 6 targets identified over an additional 8km strike length.”

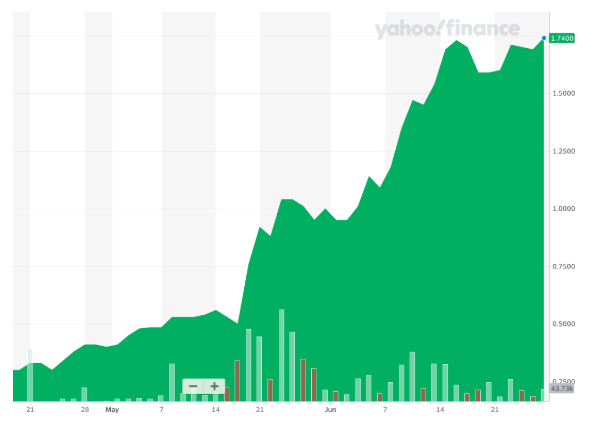

Recent financings include an oversubscribed non-brokered private placement closed this past month for over $6.3 million total. The market is already anticipating great things as Norsemont’s share price has rocketed from $0.40 to $1.70, but Larmour argues the company is still highly undervalued. He points to other comparable gold explorations assets with similar resources getting $50 USD to $96 CAD per ounce in the ground, according analyst-compiled data. “You could do the math and conservatively assume a much higher evaluation on what we have.” First order of business is to release an NI-43-101 compliant resource estimate this summer. After some additional funding Norsemont intends to do another 50,000 metres of deeper core drilling. “Once we prove up even more ounces, it wouldn’t take too much capital to scale up the mine plan to significantly increase production.”

While Chile is starting to lighten its COVID-19 restrictions, the project benefits from a local team including head consultant Darby Fletcher who holds a PhD from Stanford and has worked with the likes of Bema Gold, Osisko, South Peru Copper and Newmont. He has lived in Iquique Chile for the last 15 years, which is conveniently close to Choquelimpie. Another staffer is Jamie Alcazar, a local, senior Chilean geologist who worked on the project as recent as 2015. Working with the local team under COVID-19 guidelines, Norsemont anticipates a fruitful exploration program in the months to come.

All said on gold-silver, in 2006-2008 Rio Tinto did a comprehensive analysis on the project and concluded a significant copper gold porphyry likely existed at greater depths — something that could be of further interest to a major as the project develops.

For now, Larmour says the focus is to unlock the value of the gold-silver mineralization at surface. “We know there is lots more value there, we just need to prove it.”

DISCLAIMER: While all information is believed to be reliable, it is not guaranteed by us to be accurate. Individuals should assume that all information contained in our article is not trustworthy unless verified by their own independent research. Also, because events and circumstances frequently do not occur as expected, there will likely be differences between any predictions and actual results. Always consult a licensed investment professional before making any investment decision. Be extremely careful, investing in securities carries a high degree of risk; you may likely lose some or all of the investment. Furthermore, it is certainly possible for errors or omissions to take place regarding the profiled company, in communications, writing and/or editing. Nothing in this publication should be considered as personalized financial advice. We are not licensed under any securities laws to address your particular financial situation. No communication by our employees to you should be deemed as personalized financial advice. Please consult a licensed financial advisor before making any investment decision. This is a paid advertisement and is neither an offer nor recommendation to buy or sell any security. We hold no investment licenses and are thus neither licensed nor qualified to provide investment advice. The content in this article is not provided to any individual with a view toward their individual circumstances. Baystreet.ca has been paid a fee of one thousand nine hundred dollars from stocksocial for distribution of this article. This compensation constitutes a conflict of interest as to our ability to remain objective in our communication regarding the profiled company. Because of this conflict, individuals are strongly encouraged to not use this article as the basis for any investment decision. By reading this communication, you agree to the terms of this disclaimer, including, but not limited to: releasing Baystreet.ca, its affiliates, assigns and successors from any and all liability, damages, and injury from the information contained in this communication. You further warrant that you are solely responsible for any financial outcome that may come from your investment decisions.